Pret’s coffee subscription model, launched during the pandemic, was a bold attempt to drive customer loyalty and foot traffic with an ‘unlimited’ coffee offer. This article explores how the model seemed viable, the strategies Pret used to sustain it, and the valuable insights gained from this innovative experiment.

Audio summary (credits: NotebookLM)When I first heard about Pret’s coffee subscription—five drinks a day for just £30 a month—it sounded almost too good to be true, especially when a single coffee costs £3.50 on average. The offer was simple: pay £30 monthly for up to five barista-made drinks per day. Pret launched this during the height of the pandemic, when foot traffic in cities was reduced, and many people were working from home—an initiative designed to pull customers back into their stores.

Three years after its launch, Pret has ended the ‘5 coffees a day’ offer, pivoting to a new subscription model. This article explores how the model was viable, the key decisions Pret made to sustain it, and possible reasons for the eventual shift.

Applying the SaaS Model to Coffee

Five coffees a day is practically unlimited, as very few people actually consume that much daily. With nearly bottomless coffee, Pret emulated the business model of tech companies that offer software as a service (SaaS), using a fixed monthly fee regardless of usage. For instance, Netflix’s subscription fee remains the same no matter how much time you spend watching. Similarly, Google Drive has storage caps for each tier, but users within a tier pay the same fee regardless of how often they upload or download files or how much data they store.

This model works well in software because of the low marginal costs associated with digital products; once built, the cost to serve additional users is minimal. To understand why Pret saw potential in a similar approach for coffee, we need to examine the cost structure of coffee service.

Marginal Cost of a Coffee

First, let’s consider the marginal cost—the cost of producing one additional unit of a product. For coffee shops, the marginal cost of a coffee is surprisingly low. The below estimates show that it costs around £1 to make one cup of coffee.

- Coffee beans: £0.50

- Milk: £0.30

- Sugar/Syrup: £0.10

- Cup and lid: £0.20

- Utilities (electricity/water): £0.05

Other expenses, such as rent, equipment, and barista wages, remain fixed and don’t increase with each coffee made. This low marginal cost makes the subscription model appear feasible on paper.

However, if a customer were to get one drink every day (30 drinks per month), Pret’s cost would be roughly £30—essentially breaking even on the subscription price. So it could have worked if the customers were fair in using the service.

However, as we know, customers don’t all use subscriptions in the same way. It’s time to explore Differential Service Utilization.

The Role of Differential Service Utilization

In a subscription model, all customers pay the same fee, but usage varies significantly, resulting in different costs per customer. Typically, customer usage falls into three categories:

- Light users who barely use the service

- Moderate users who get good value without maximizing usage

- Heavy users who extract the maximum value

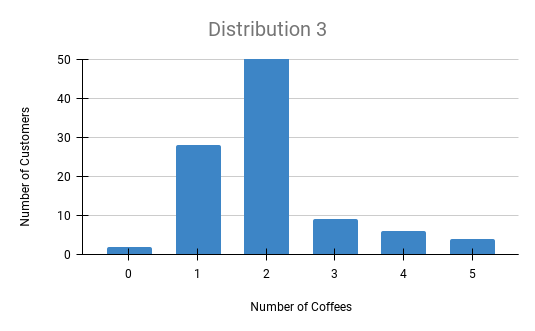

Therefore, serving costs depend on the balance among customer types, with each contributing differently to total costs. Let’s assume there are 100 customers—the cost to serve them depends on the number of coffees each one consumes. Below are five sample distributions over five days, showing different numbers of coffees per person each day.

The most likely scenario is Distribution 3, where most people have one or two coffees daily. The table below shows the cost to serve as a percentage of revenue for each distribution:

| Metric | Distribution 1 | Distribution 2 | Distribution 3 | Distribution 4 | Distribution 5 |

|---|---|---|---|---|---|

| Number of Customers | 100 | 100 | 100 | 100 | 100 |

| Daily Subscription Revenue (£) | £100 | £100 | £100 | £100 | £100 |

| Total Coffees Served | 93 | 132 | 201 | 255 | 251 |

| Total Coffee Cost (£1 per coffee) | £93 | £132 | £201 | £255 | £251 |

| Contribution Margin (£) | £7 | -£32 | -£101 | -£155 | -£151 |

| Contribution Margin (%) | 7.53% | -24.24% | -50.25% | -60.78% | -60.16% |

As you can see, Pret’s costs are only favorable in Distribution 1, where most customers consume fewer than two coffees per day. But in most scenarios, costs quickly exceed revenue, creating a negative contributing margin. To offset this, Pret relies on a third factor to improve outcomes in distributions 2 to 5 —additional in-store purchases.

The impact of In-store Purchases

Pret’s strategy went beyond coffee revenue alone. By offering a 20% discount on food items for subscribers, they aimed to increase the average spend per visit, leveraging a fundamental retail principle: the value of attracting customers into the store.

With this discount, subscribers are more likely to add lunch, breakfast, or snacks to their coffee orders. Since the marginal cost of these food items is relatively low, additional food purchases help offset the narrow margins on coffee.

For instance, if each customer spends £5 on food per visit, with a marginal cost of £2, the margins across different distributions of coffee consumption are shown below:

| Metric | Distribution 1 | Distribution 2 | Distribution 3 | Distribution 4 | Distribution 5 |

|---|---|---|---|---|---|

| Number of Customers | 100 | 100 | 100 | 100 | 100 |

| Daily Subscription Revenue (£) | £100 | £100 | £100 | £100 | £100 |

| Total Coffees Served | 93 | 132 | 201 | 255 | 251 |

| Total Coffee Cost (£1 per coffee) | £93 | £132 | £201 | £255 | £251 |

| Food Revenue (£5 per visit) | £465 | £660 | £1,005 | £1,275 | £1,255 |

| Food Cost (£2 per visit) | £186 | £264 | £402 | £510 | £502 |

| Contributing Margin (£) | £286 | £364 | £502 | £610 | £602 |

| Contribution Margin (%) | 102.51% | 91.92% | 83.25% | 79.74% | 79.95% |

As shown, margins improve substantially across all distributions, even those where customers consume more than two coffees per day. However, if we assume a more conservative scenario in which each £5 food spend corresponds to every two coffees consumed, the revised margins appear as follows:

| Metric | Distribution 1 | Distribution 2 | Distribution 3 | Distribution 4 | Distribution 5 |

|---|---|---|---|---|---|

| Number of Customers | 100 | 100 | 100 | 100 | 100 |

| Daily Subscription Revenue (£) | £100 | £100 | £100 | £100 | £100 |

| Total Coffees Served | 93 | 132 | 201 | 255 | 251 |

| Total Coffee Cost (£1 per coffee) | £93 | £132 | £201 | £255 | £251 |

| Food Revenue (£5 per visit) | £233 | £330 | £503 | £638 | £628 |

| Food Cost (£2 per visit) | £93 | £132 | £201 | £255 | £251 |

| Contributing Margin (£) | £147 | £166 | £201 | £228 | £226 |

| Contribution Margin (%) | 78.76% | 62.88% | 49.88% | 44.61% | 44.92% |

Even under the more conservative assumption, margins remain favorable. Pret’s model relied on the draw of ‘free’ coffee to attract customers, with the goal of increasing the average basket size through food purchases.

However, if customers only redeemed the coffee without making additional purchases, Pret’s narrow coffee margins would quickly face pressure, as high coffee consumption without offsetting revenue from food sales would erode profitability and make the model financially unsustainable.

Key Choices Pret Made to Manage the Subscription

As we’ve seen, the success of a coffee subscription model largely hinges on customer behavior—specifically, the number of coffees consumed and the average cart size. Pret kept the overall subscription model straightforward but made a few strategic choices to ensure its sustainability:

- The 30-Minute Time Restriction Between Coffees: This was an effective constraint that discouraged quick back-to-back orders, helping to prevent sharing among friends or coworkers. By enforcing a 30-minute delay between redemption, Pret ensured the subscription remained personal and encouraged multiple visits throughout the day.

- The 20% Discount on Other Items: Offering a 20% discount on non-coffee items was a smart move to boost basket size. While it might seem counterintuitive to add another discount for subscribers already receiving discounted coffee, Pret aimed to turn coffee visits into full meal purchases. By slightly lowering the cost of food, Pret hoped to capitalize on impulse buys, knowing that food typically has higher profit margins than coffee.

- QR Code for Redemption: Subscribers needed to scan a QR code from Pret’s app at the time of payment to redeem their benefits. This system was user-friendly and helped onboard new customers seamlessly. Additionally, security features like preventing screenshots and enforcing the 30-minute rule reduced the risk of misuse.

- Simple, Uncomplicated Rules: Pret avoided additional rules that might have cut costs but could deter customers. For instance, they could have charged for disposable cups (£0.50 per cup would have reduced marginal costs and encouraged eco-friendly practices) or added peak-hour restrictions. Adding such conditions could be detracting from its appeal. This commitment to simplicity likely helped drive adoption and customer satisfaction.

What Pret Gained from the Experiment

The concept of “unlimited” coffee isn’t as impractical as it might initially sound, and as we’ve seen, Pret likely didn’t incur a loss with this model. However, the sustainability of Pret’s subscription ultimately depended on the additional margins it could generate compared to a non-subscription model. Without concrete data, it’s hard to say definitively, but with in-store foot traffic returning to normal levels, the model may not have provided significant long-term financial benefits.

While I’m disappointed that the unlimited coffee fun has ended, Pret likely gained valuable insights and strategic advantages from this experiment.

Even if the subscription model proved unsustainable in its original form, it offered long-term benefits that could shape Pret’s future approach in meaningful ways:

- App Sign-Ups: One of the biggest challenges for a coffee chain—or any brick-and-mortar business—is driving app downloads. Pret succeeded here, thanks to the subscription’s appeal. With customers regularly using the app, Pret can streamline the redemption process while gaining valuable insights into customer behavior. An active app user base is a powerful strategic asset.

- Understanding User Behavior: Through this experiment, Pret developed a deeper understanding of customer behavior and buying patterns, providing invaluable data for future offerings and in-store promotions. Knowing if customers are light or heavy coffee drinkers allows Pret to tailor promotions and potentially design more sustainable subscription models.

- Digital Communication: Beyond app sign-ups, Pret now has direct digital access to customers through email and in-app notifications, making it easier to engage customers and keep them informed about offers, new products, and subscription changes. These communication channels give Pret a major advantage in driving future campaigns and maintaining customer engagement.

- Customer Retention: Although the original subscription model has changed, it helped lay a foundation for stronger customer retention. Pret has since introduced a new, likely more sustainable subscription model. Loyal customers, now accustomed to the convenience of using the app, are more likely to remain engaged. While the new model may not have the allure of “free” coffee, it is likely designed to balance customer satisfaction with profitability, ensuring the longevity of Pret’s customer base.

The Lasting Impact

While most coffee brands’ loyalty programs focus on collecting stamps for a free coffee after every 6th or 10th purchase, Pret’s model stood out as fresh and innovative. This bold experiment delighted coffee lovers and brought significant attention to the brand during a challenging time. Although Pret has moved on from its original model, it demonstrated the power of simple, customer-friendly offerings in building loyalty and driving foot traffic.

The experiment yielded lasting benefits: valuable insights into user behavior, a growing digital presence through app sign-ups, and new channels for direct communication with customers. These tools are likely to position Pret to better understand its customers and refine its customer engagement strategy for years to come.

Leave a reply to Rakesh Cancel reply